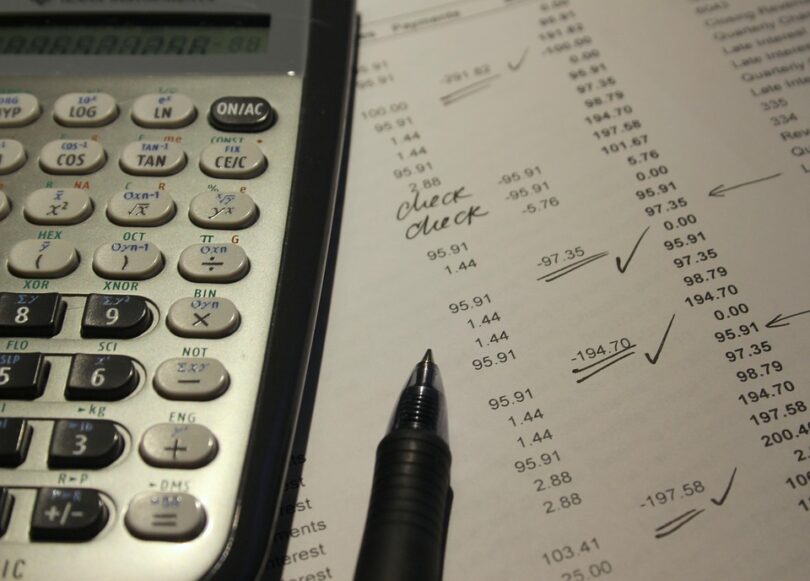

Creating a budget is one of the most critical aspects of running a successful small business. This guide aims to provide you with a comprehensive understanding of how to set up and maintain an effective budget.

<section>

<h2>Understanding the Importance of a Budget</h2>

<p>A budget acts as a financial roadmap for your business. It helps you understand your income, allocate resources efficiently, and prepare for future uncertainties. Key benefits include:</p>

<ul>

<li>Tracking Spending: Knowing where your money goes can highlight areas for improvement.</li>

<li>Setting Financial Goals: A budget helps in establishing short-term and long-term financial goals.</li>

<li>Identifying Cash Flow Patterns: Understanding your inflows and outflows aids in managing cash flow effectively.</li>

</ul>

</section>

<section>

<h2>Steps to Create a Business Budget</h2>

<h3>1. Evaluate Your Revenue Streams</h3>

<p>Begin by identifying all potential revenue sources. This includes sales, services, investments, and any other income. Understanding your expected revenue will set the foundation for your budget.</p>

<h3>2. List Your Expenses</h3>

<p>Next, categorize your expenses into fixed and variable costs:</p>

<ul>

<li><strong>Fixed Costs:</strong> Rent, salaries, utilities.</li>

<li><strong>Variable Costs:</strong> Marketing, raw materials, operational expenses.</li>

</ul>

<h3>3. Create a Budget Template</h3>

<p>A budget template serves as your budgeting framework. You can create one using spreadsheets or finance software. Include sections for revenue, expenses, and net profit.</p>

<h3>4. Determine Your Net Profit</h3>

<p>Calculate your net profit by subtracting total expenses from total income. This figure will indicate whether your business is profitable or operating at a loss.</p>

<h3>5. Monitor and Review</h3>

<p>Your budget is a living document and should be reviewed regularly. Compare actual financial performance against the budget, and adjust as necessary. Regular monitoring can help identify trends and areas for improvement.</p>

</section>

<section>

<h2>Tools for Budgeting</h2>

<p>There are many tools available for creating and monitoring your budget:</p>

<ul>

<li><strong>Excel or Google Sheets:</strong> Flexible and customizable spreadsheet options.</li>

<li><strong>Accounting Software:</strong> Tools like QuickBooks, FreshBooks, or Xero can simplify budgeting.</li>

<li><strong>Budget Apps:</strong> Apps like Mint or You Need a Budget (YNAB) allow for easy tracking on the go.</li>

</ul>

</section>

<section>

<h2>Common Budgeting Mistakes to Avoid</h2>

<p>As you embark on your budgeting journey, be mindful of these common pitfalls:</p>

<ul>

<li>Not accounting for irregular expenses, such as taxes and maintenance.</li>

<li>Being overly optimistic about revenue predictions.</li>

<li>Failing to adjust the budget based on performance and changing circumstances.</li>

</ul>

</section>

<section>

<h2>Conclusion</h2>

<p>Creating a budget for your small business is not just about crunching numbers; it’s about gaining control over your finances. A well-structured budget will enable you to make informed decisions, plan for the future, and ultimately grow your business. By following these steps, using proper tools, and avoiding common mistakes, you'll be well on your way to financial stability and success.</p>

</section>

<section>

<h2>FAQs</h2>

<h3>1. How often should I update my budget?</h3>

<p>It's advisable to review your budget monthly, quarterly, or at least annually, based on your business's financial activity.</p>

<h3>2. What if my expenses exceed my revenue?</h3>

<p>If your expenses exceed your revenue, you may need to cut costs, increase prices, or find new revenue streams until the balance is restored.</p>

<h3>3. Can I use a personal budget template for my business?</h3>

<p>While personal budget templates can work for small-scale businesses, it's better to use a dedicated business budgeting template that considers unique business expenses and revenue streams.</p>

<h3>4. Should I include all expenses in my budget?</h3>

<p>Yes, it’s crucial to include all fixed and variable expenses in your budget for an accurate financial picture.</p>

<h3>5. How can I improve my budgeting skills?</h3>

<p>Improving your budgeting skills involves regular practice and learning from financial reports. Consider using finance courses or workshops to enhance your understanding.</p>

</section>

<footer>

<p>© 2023 Your Business Name. All rights reserved.</p>

</footer>